Senate Passes Higher Tax Rates On Rich To Avert ‘Fiscal Cliff’ Crisis

As the clock struck midnight on January 1, 2013, America technically went over the so-called “fiscal cliff.”

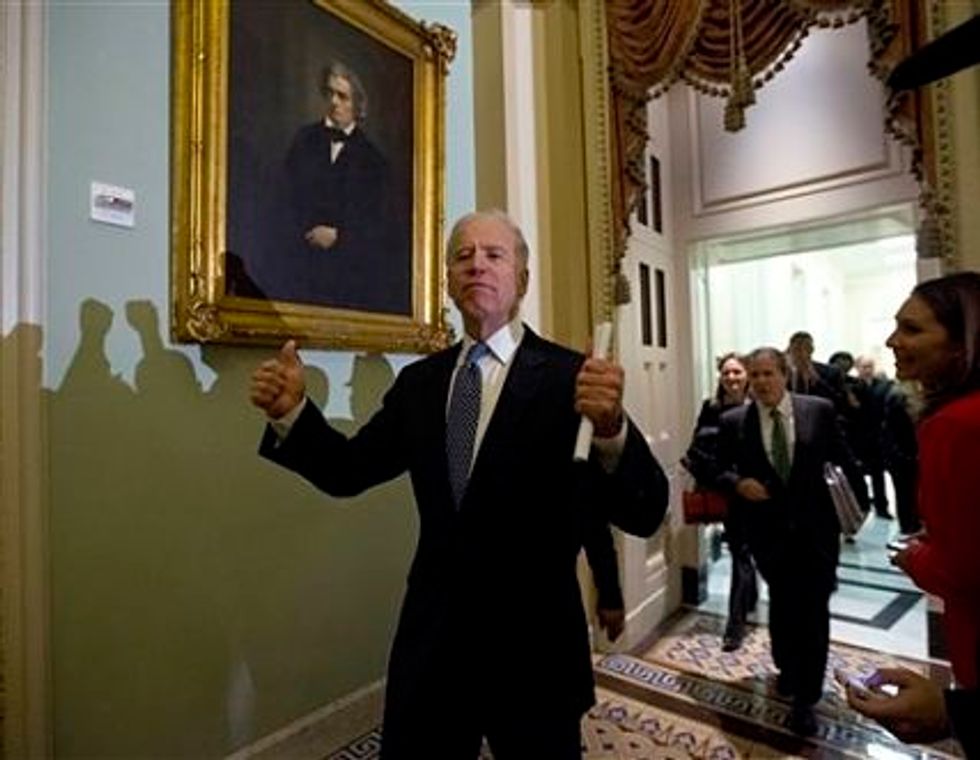

Within hours, the Senate voted 89-8 for a deal negotiated by Vice President Joe Biden that extends the Bush-era tax cuts — which had expired at midnight — on all incomes under $400,000 for single filers and under $450,000 for joint filers, while delaying the sequestration budget cuts for two months until just before America hits the debt limit.

The bill also includes a one-year extension of emergency unemployment insurance, and tax credits that help the poor and green energy development.

The Senate vote puts America out on the “fiscal ledge,” as the House still needs to approve the bill. House Speaker John Boehner is set to meet with his caucus Tuesday at 1 PM EST.

The speaker reportedly feels that he will have a hard time selling the bill. Rep. Tim Huelskamp (R-KS), one of the members who helped kill Boehner’s “Plan B” budget proposal, has already said he will oppose the bill.

Despite the fact that Republicans have allowed tax rates on the richest to rise without demanding cuts to Medicare or Social Security — establishing the most progressive tax code in generations — some liberals like Senator Tom Harkin (D-IA) are furious that the president is cedeing nearly $200 billion in revenue by raising the threshold of the top tax rate from $250,000, a number he campaigned and won on.

They also believe that the president has allowed Republicans to set up another “hostage situation” in just months.

“Republicans haven’t conceded anything on the debt ceiling,” former Secretary of Labor Robert Reich wrote, “so over the next two months — as the Treasury runs out of tricks to avoid a default — Republicans are likely to do exactly what they did before, which is to hold their votes on raising the debt ceiling hostage to major cuts in programs for the poor and in Medicare and Social Security.”

The president has claimed that he will not let the debt limit be held hostage again, but he hasn’t made it clear if he’d go as far as to invoke the 14th Amendment to avoid a standoff. In a statement Monday, he suggested that more revenue from the richest would have to be part of any deal to reform Medicare. His only leverage to secure a “balanced” deal by March are the defense cuts in the sequestration, which the GOP adamantly opposes — and the popularity of Medicare, which has an approval rating that even the Clintons might envy.

One of the handful of senators who opposed the bill is Senator Marco Rubio (R-FL), widely considered to be a frontrunner for the 2016 GOP presidential nomination. This puts the spotlight on House Budget Committee Chairman and former vice presidential nominee Paul Ryan (R-WI), who will probably support the bill. Ryan, like most Republicans, will likely spin that he’s voting for a tax cut because the lower Bush tax rates had expired.

Taxes will go up on middle-class Americans in 2013 regardless, as there is no extension of the payroll tax cuts from 2010 and 2011 in the deal.

Despite the higher marginal tax rates, the richest Americans fared better in other parts of the deal. Yes, the Senate voted to raise taxes on capital gains and dividends for Americans who earn over the $400,000/$450,000 threshold — but only slightly, from 15 percent to 20 percent. This means multi-millionaires like Mitt Romney who derive most of the income from investments will still be paying lower rates than many working-class Americans.

In addition, the estate tax will have a threshold of $5,000,000 indexed to inflation. This tax on the inheritances only hits the wealthiest Americans but is unpopular on both sides of the aisle since it can force the dissolution, in some cases, of family farms.

The bill also took care a lot of Senate business that had been left to the last minute. The Farm Bill will be extended for 9 months, ensuring that the price of milk won’t suddenly double. It also includes the “Doc fix,” which ensures that the cuts to doctors who work for Medicare won’t be cut precipitously. Like a college student cramming, the Senate completed all the business they’d had before them for months in just a few hours.

Assessing any real “winner” in the “fiscal cliff” at this point would be premature. So much depends on what the cuts and tax reforms forged in the heat of the next constructed crisis will turn out to be. But for now, if the House GOP doesn’t get in the way, any self-inflicted economic damage has been delayed.

Photo credit: AP Photo/Alex Brandon