For Consumers, Fed’s Expected Rate Hike Is Unlikely To Cause Shock And Awe

By Jim Puzzanghera, Los Angeles Times (TNS)

WASHINGTON — Federal Reserve policymakers are expected to end months of speculation Wednesday and raise a key interest rate for the first time in nearly a decade.

But for average Americans hoping for noticeably higher returns on their savings or fearing a sharp increase on credit card, auto loan or mortgage rates, the waiting is likely to continue.

“It’s much like that first dusting of snow,” Greg McBride, chief financial analyst for financial information website Bankrate.com, said of the much-anticipated Fed rate hike. “That’s not what cancels school and messes up traffic. But it’s the signal that winter’s coming.”

Fed Chair Janet Yellen and her colleagues would be sending a symbolically powerful signal that they believe the economy finally has recovered enough from the Great Recession to start reversing seven years of holding the central bank’s benchmark short-term interest rate near zero.

But the increase in the so-called federal funds rate this week is likely to be minuscule: just 0.25 percentage point. The next similarly small move probably would not come until March or even June.

Yellen has stressed that the Fed plans to move slowly so the rate, which is used to set terms for many consumer and business loans, would remain low for a while. Low rates encourage consumers and businesses to spend rather than save, which boosts economic growth.

The small increase — coupled with the lingering effects of the central bank’s unprecedented stimulus efforts — would increase the typical delay it takes for consumers to feel any effect from a rate change, experts said. This time, the lag is expected to be lengthier because the rate has been so low for so long and the Fed is going to inch it up gradually.

“The rate increase is likely to be tiny, and I’m not sure it’s going to have an effect that will shock and awe anybody,” said James Chessen, chief economist at the American Bankers Association.

The Fed’s actions also get diluted as they flow through the financial system, particularly to the savers who have been hardest-hit by the near-zero interest rate. Savers shouldn’t anticipate a bump in their balances any time soon because banks, squeezed by low rates and holding record-high deposits, aren’t eager to start paying out more to their customers.

The federal funds rate applies to short-term lending between banks from the reserves they hold at the Fed. But the rate affects other borrowing costs and has become a benchmark for savings accounts, certificates of deposit, credit cards, auto loans, small business loans and home equity lines of credit.

The federal funds rate has less of a direct effect on longer-term loans, particularly mortgage rates. Those rates generally have already risen in anticipation of Fed action.

The last time the Fed began a period of rate boosts was in 2004, when it made a similar 0.25 percentage point move. It increased rates 16 more times over the next two years.

©2015 Los Angeles Times. Distributed by Tribune Content Agency, LLC.

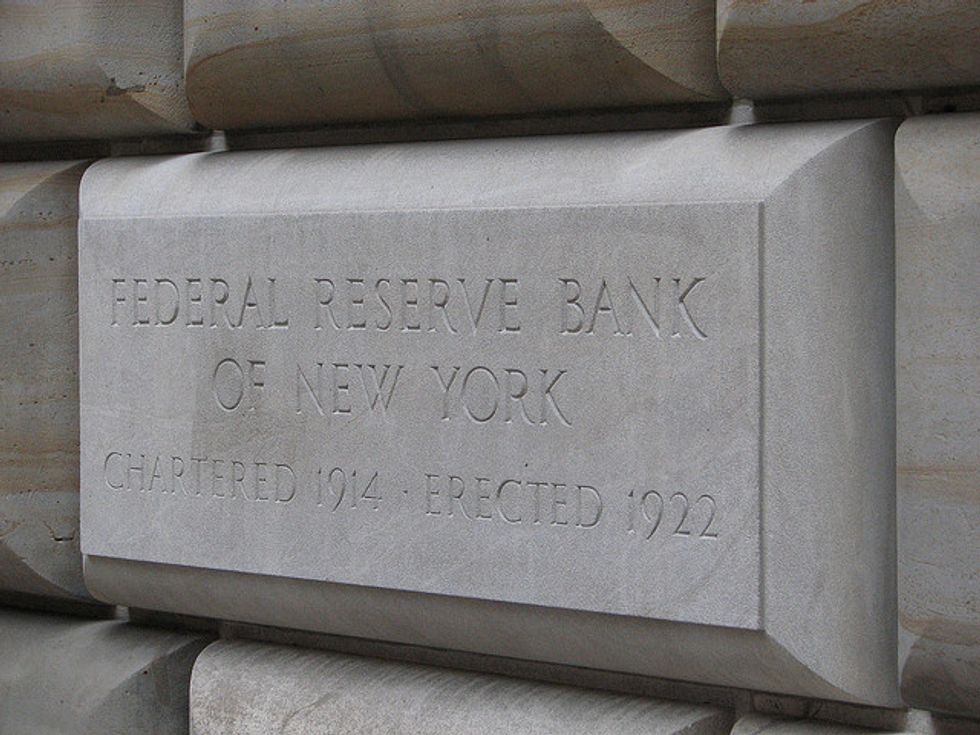

Photo: Michael Daddino via Flickr