Obama Drops Proposed Tax Increase On College Savings Plans

By Kevin G. Hall and Lesley Clark, McClatchy Washington Bureau (TNS)

WASHINGTON — Under bipartisan pressure, the White House Tuesday quietly abandoned a proposal to raise taxes on a popular program used to save for college.

President Barack Obama had proposed earlier this month to eliminate tax breaks adopted in 2001 for new contributions to 529 college savings plans. But he faced a backlash in the recent week from members of both political parties, as well as operators and users of the state-based plans.

“A tremendous outpouring of support for retaining these 529 tax incentives has come from 529 plans, members of Congress, the media, and, most importantly, the families who have benefited and are benefiting from their participation in a 529 plan and achieved a better life through post-secondary education,” said an alert from the Virginia program.

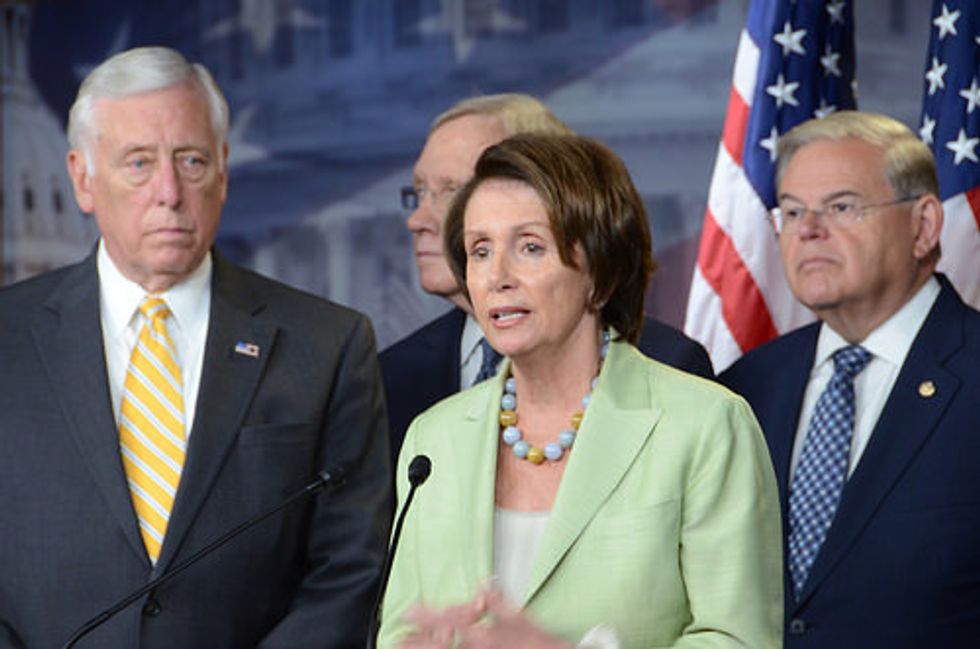

A White House official, speaking on condition of anonymity as part of administration policy, said that Obama decided to drop the proposal after a personal plea from House Minority Leader Nancy Pelosi (D-CA) aboard Air Force One en route from India to Saudi Arabia. The top Democrat on the House Budget Committee, Maryland’s Chris Van Hollen, also lobbied the administration.

Republicans also pressed to drop the proposal.

The 529s, created in 1996 and established now in nearly every state, work similar to a 401(k) retirement plan or an individual retirement account, where money is invested and grows without being taxed if upon withdrawal it is used for college tuition or qualified college expenses.

There are an estimated 7 million plans now in existence.

“I’m glad President Obama has decided to listen to the American people and withdraw his tax hike on college savings,” House Speaker John Boehner (R-OH) said. “This tax would have hurt middle-class families already struggling to get ahead.”

Sen. Charles Grassley (R-IA), who was chairman of the Finance Committee when the 529s were modified in 2001 and boomed, said the programs are popular among the middle class.

“The statistics suggest that Iowa’s program is used by parents and grandparents who are making an effort to set aside money to save for their children and grandchildren’s education,” Grassley said.

The issue is far from dead, as Republicans had already been pushing to expand the use of 529s. Rep. Lynn Jenkins (R-KS) has already introduced bipartisan legislation to expand a tool many families use to save for college.

“It took a public backlash for the president to realize that taxing college savings plans was a bad idea. But withdrawing the proposal is not enough,” said Rep. Paul Ryan (R-WI), the new chairman of the tax-writing House Ways and Means Committee, calling on Obama to support Jenkins’s plan.

Photo: House Democrats via Flickr