Reprinted with permission fromAlterNet.

There’s something about taxes that elected Republicans know, but most Americans are completely unaware of. It’s the reason we keep falling for the perennial GOP tax scam, and Paul Ryan, Mitch McConnell, and their buddies in the White House are getting ready to run this ruse on American working people all over again.

Here it is in a nutshell: Tax cuts for truly wealthy people increase their income and wealth; tax cuts for working people actually decrease their income and wealth over time.

Here’s how it works.

If you’re part of the top 0.1% – say you’re earning a million dollars a year – and you get a tax cut, you’ll keep more of the money you’re earning. The main reason is because people in those income categories 1) generally have a high degree of control over their own income; and 2) they more often than not already are working under a massive tax cut – at least a lower tax rate – called the capital gains tax. But even setting aside Part II of that, truly super-high income earners, like the banksters on Wall Street or CEOs of large corporations, have a significant measure of control – if not total control – over their own income.

For working people, it’s an entirely different story.

Let’s say for the sake of argument that I’m a super-wealthy entrepreneur and I own the company you work for. While I can set my own paycheck (within the parameters of money available to the company), I also set your paycheck. But that’s largely a “market function” – that is, I pay as little as possible for the right talent to get the work done.

So if we live in a country where working people pay, to use round numbers for example, a 50% tax bracket, and I know that you need $50,000 a year after taxes to live, and pretty much anybody who’s applying for your job will also demand at least a $50,000 take-home pay, I’ll set the wage for that particular job at $100,000 a year. At a 50% tax rate, that gives you $50,000 after taxes.

As the company owner, let’s say that I’ve set my own salary at $1 million a year, which means I’m taking home around $500,000 a year at a 50% tax rate (of course, taxes are progressive, but that’s not relevant to this argument as Republicans want to “cut taxes for all income brackets,” so for simplicity sake let’s assume the “flat tax” Republicans say they love so much).

Now, what happens if Democrats come into power and say that they want to build a national high-speed rail system, and need to raise taxes to 60% to do it. What happens to my pay and to yours?

For me, my net take-home income goes down from $500,000 to $400,000 a year, but I can easily fix that by simply increasing my pay to $1.2 million. After all, this is a billion-dollar company, and a little bit here and there for me and my executives is no big deal.

But you – and anybody else doing the particular job you’re doing – still need $50,000 take-home pay in order to live. So if your taxes go up, and I want to keep you as an employee, I’m going to have to raise your pay by enough to keep your take-home even.

This is why when taxes go up on working people – as they did dramatically from 1913 to 1980 – pay went up dramatically, too.

This is also why high-tax countries pay higher wages (and have better public services, paid for with those taxes). In Denmark, for example, the average full-time MacDonald’s worker earns around $45,000 U.S. equivalent, although about 40% of that goes to taxes to pay for the national health-care system, one of the world’s best school systems, and high-quality high-paid police who treat Danes with respect.

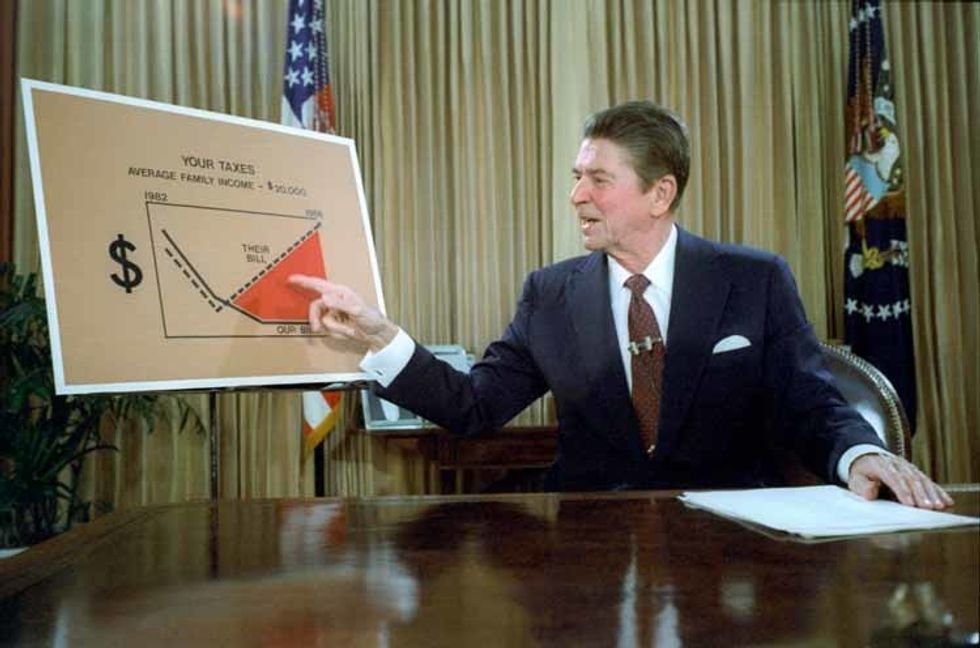

On the flip side, what happens when Republicans come into power and decide to cancel the government expenditures and “return people’s income to them” by lowering taxes? Let’s say they drop the tax rate from 50% to 25% (Reagan actually dropped the top rate from 74% to 25%). What happens to me and you?

As the CEO who controls his own income, I continue to take my $1 million, but my take-home goes from $500,000 up to $750,000. I get richer – and rapidly – and I can stash that money in a Swiss bank account.

But I still know that you can only really live on $50,000 a year, and thus are only willing to do your job for that as take-home pay.

However, with a $100,000 before-tax salary, you’ll now be taking home $75,000 – way more than I know you need.

So, what does an employer do? He cuts your pay down enough that you’re only still taking home $50,000 a year. Your $100,000 salary will – over time, and through the process of layoffs and attrition, letting go of higher-paid people, and hiring lower-paid people – drift down to around $75,000, so you’re still taking home $50K.

A 25% cut in taxes on working people will give a short-term boost to paychecks, but over a period of a few years it’ll mean working people’s before-tax wages will drop by about 25%. Employers, after all, know the minimum amount of take-home pay working people are willing to work for (aka “the labor market”).

This is why when Republicans cut taxes, wages go down or stay flat for working people, a phenomenon we’ve watched over and over again since Reagan began this process in the 1980s.

Today, when the “older” (as in, “earning the old pay scale from when taxes were higher”) workers move on or retire, they’re replaced with new lower-paid workers. Factory jobs that used to pay $30/hour or more, for example, now pay $14/hour (check out the GM contracts negotiated over the past few decades as a vivid example).

According to economist Thomas Piketty, the poorest 50 percent of Americans have seen their incomes decline by a full 1 percent since 1978— even as incomes for the top 10 percent of Americans have jumped by whopping 115 percent and incomes for the top .001 percent have skyrocketed an astronomic 685 percent.

The aforementioned progressive nature of our tax code – big changes at the top are matched by much smaller changes at the bottom – accounts for why wages have “merely” been flat or declined “only” 1% since Reagan, whereas wealth at the top has exploded under “conservative” tax policies.

Meanwhile, the larger effect of tax cuts defunding government will see the power of corporations and billionaires grow, while the ability of government to do things will shrink.

We’ve gone from NASA sending men to the moon to having to rely on private corporations to send rockets up to refill the space station. Starting with Reagan’s government-defunding billionaire-friendly tax-cuts in the 1980s we stopped building and even repairing much of our infrastructure, causing the deterioration of our nation to nearly developing-world status in many parts of the country.

So, with the GOP in power, get ready to see working people’s pay start dropping again, as it did starting in the 1980s after Reagan’s tax cut and in the early 2000s after Bush’s. Also get ready to see income inequality grow even worse, as the truly rich see a big boost in their take-home pay and thus their overall wealth, while working people and our nation’s infrastructure get screwed.

And get ready for voters who have no idea how this all works to get totally behind the GOP “we’ll cut your taxes” rhetoric, not realizing that Paul Ryan, Mitch McConnell, and Donald Trump/Mike Pence view us all as merely useful idiots.

Thom Hartmann is an author and nationally syndicated daily talk show host