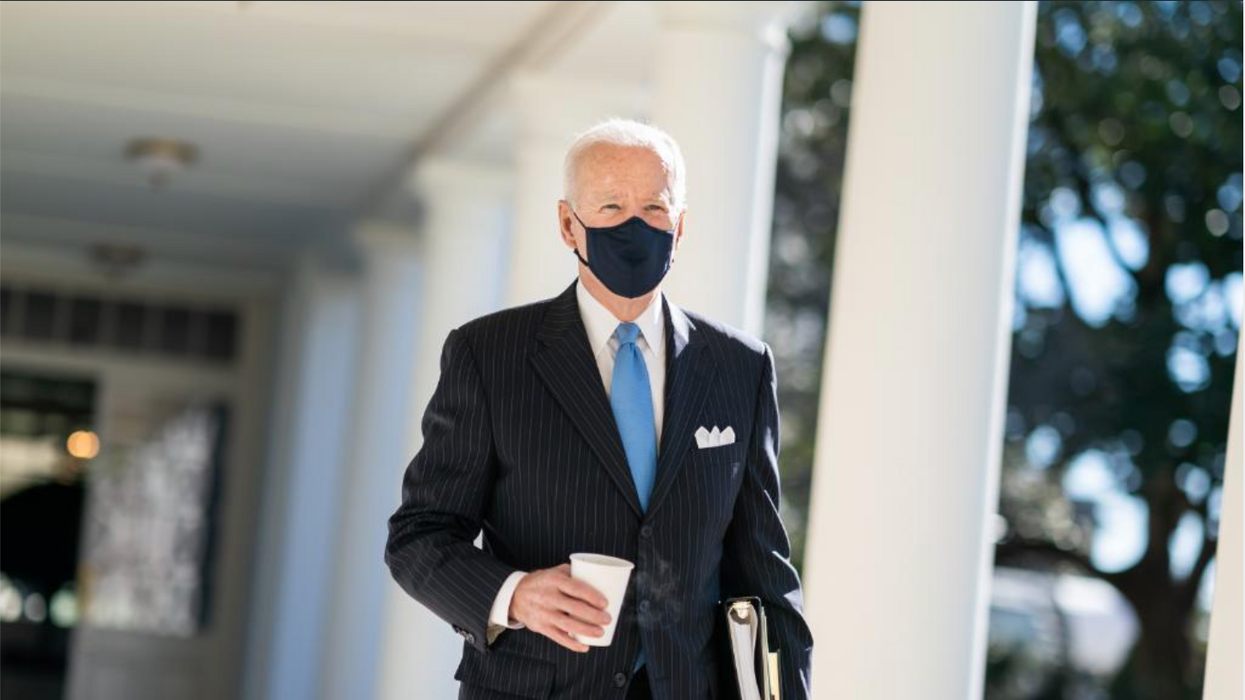

Biden Plan Includes Much Bigger Tax Cut For Most Families Than Trump Tax Bill

Reprinted with permission from American Independent

In addition to the hundreds of billions in pandemic relief spending in President Joe Biden's $1.9 trillion American Rescue Plan, a new Tax Policy Center analysis finds it will also provide a massive one-time tax cut for lower- and middle-income Americans.

Their evaluation — published Monday — examined the 2021 tax impacts of the version of the bill that passed the Senate on Saturday and will likely receive final approval in the House of Representatives this week. For the average American, the legislation will mean a $3,040 tax cut for the year.

The cuts come in the form of expanded child tax credits, earned income tax credits, and child and dependent care tax credits.

Despite running on a platform of lower taxes, House and Senate Republicans have unanimously opposed the American Rescue Plan. House Minority Leader Kevin McCarthy (R-CA) mocked the bill as a "Pelosi payoff" in a February 26 op-ed, warning the legislation "will result in families, children and small businesses continuing to get left behind, saddled with a debt they cannot afford, all for the sake of an agenda they never voted for."

But according to Forbes, the bill will bring a much bigger average tax cut than the GOP's much-vaunted 2017 Tax Cuts and Jobs Act.

Donald Trump ran in 2016 promising a giant middle-class cut that would reduce families' taxes by more than a third. Instead, he pushed through a bill that mostly just slashed tax rates for corporations and for the wealthiest Americans.

GOP lawmakers framed that legislation as a great boon for ordinary Americans. McCarthy called it "historic tax reform" that would give Americans "that raise they've been waiting for."

When Trump signed it into law in December 2017, he praised himself for delivering "an incredible Christmas gift for hard-working Americans."

But in reality, that legislation did little for working families. While most saw a small tax cut — an average of about $1,610 per person — about 10 million American families actually saw their taxes increase from the legislation. The majority of Americans felt no impact.

A key difference is that the 2017 legislation was an eight-year policy, while this year's legislation applies only for 2021.

But the biggest difference is who benefits most. Unlike with the GOP tax legislation, the very richest Americans are not expected to save any money at all under this bill. After receiving an average tax cut of nearly $200,000 from the Tax Cuts and Jobs Act, the top 0.1 percent who make $3.4 million or above are will get no tax cut from this bill.

A family making $25,000 or less, however, will save about $2,800 on average — and the average low-income family with kids will save nearly $7,700. Middle-income families will save around $3,350 this year, compared to about $930 under the Trump bill.

In announcing the plan in January, Biden administration spokesmen noted that, "The lowest income families are particularly vulnerable in the midst of the pandemic, and President Biden is calling for one year expansions of key supports for families on an emergency basis."

Unlike Trump, Biden's legislation will actually help those who need it most.

Trump Cabinet Nominee Withdraws Over (Sane) January 6 Comments