Raising Corporate Taxes Makes Plutocrats Cry — But The People Cheer

Not only are the rich different from you and me; they're becoming more different than ever.

I'm not referring to mere millionaires but to the billionaire bunch. In the past year, while ordinary Americans have lost jobs, businesses, and homes due to the economic crash caused by the COVID-19 pandemic, America's 664 billionaires have found themselves nearly 40 percent richer than before the pandemic! These fortunate few collectively added more than a trillion dollars to their personal stashes of wealth in 2020. And practically all of them got so much richer by doing nothing : Their money made the extra money for them, because corporate stock prices zoomed even as regular people lost income.

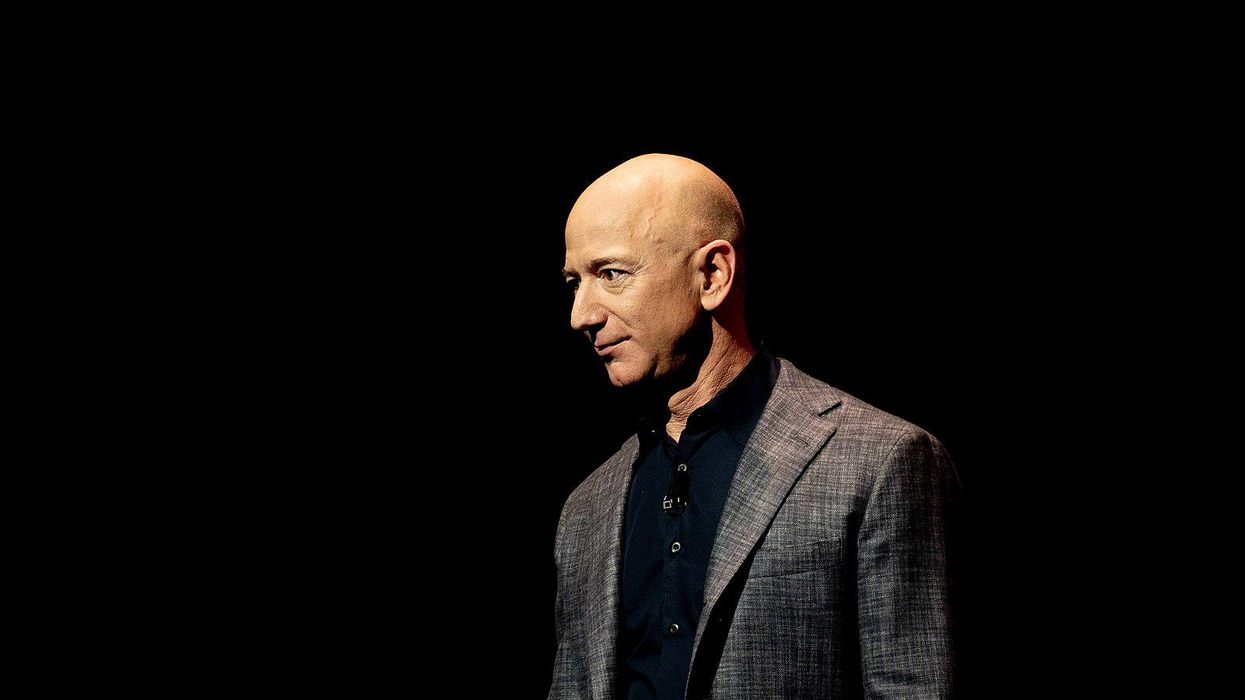

Take a peek at THE richest of these different ones: Jeff Bezos, the alpha-geek of Amazon. He hauled in an additional $75 billion last year (roughly $8.6 million an hour), giving him roughly $188 billion in total wealth. You can do a lot of good in our world with such riches ... or you can splurge on yourself.

Jeff splurged. He bought a boat — more accurately, an ocean-going ship, one of the largest sailing vessels ever built. More than one-and-a-third football fields long, the super-yacht apparently cost the diminutive mega-billionaire some half a billion bucks. But that is the price before Bezos' big boat goes anywhere: He'll reportedly pay some $60 million each year for operating expenses.

Plus, he had to buy a "support yacht" to sail along with his main boat. Why? Because the three sails on his 400-footer are so huge that a helicopter can't land on the deck, requiring an auxiliary yacht to provide a helipad.

See, the rich really are different. Where to park the helicopter while at sea is a problem you and I don't have to face.

According to mega-yacht sellers, the main draw of these ostentatious purchases is that they reinforce inequality, literally letting the rich float in leisure and luxury, oceans apart from even having to see hoi polloi like us.

"Outrageous," screeched the president of the U.S. Chamber of Commerce. "Archaic," moaned the president of the National Association of Manufacturers. "It doesn't feel fair," whimpered the chief executive of the giant Bechtel construction company.

The wailing by those who run corporate America is not for the plight of the great majority of workaday families who've seen their incomes stagnate and even plummet to zero during the past months of the coronavirus pandemic. Rather, this chorus of woe is arising from powerful plutocratic interests that have been enjoying windfall profits but now want us to feel sorry for them. Why? Because, they cry, that meanie in the White House, Joe Biden, intends to jack up their corporate tax rate up from 21 percent to 28 percent.

But wait. Didn't former President Trump and the GOP Congress slash the corporate share of our nation's upkeep nearly in half just four years ago, from 35 percent to 21 percent, shifting the burden to the middle class and poor? Yes. And didn't they promise that those cuts would create millions of new jobs and raise the incomes of the working class? Yes, again. Yet corporations got richer and working stiffs got shafted.

Still, here they come again, howling that raising corporate taxes would crash the stock market. Well, on the day Biden announced his plan, stock prices did fall ... by less than one percent. The next day, they bounced right back, and they're still booming.

Moreover, those are crocodile tears the rich are shedding, for they know that — as Biden himself makes clear — his proposed uptick in their tax share "is not going to affect their standard of living at all, not a little tiny bit." They'll still have their two or three big houses, private jets, and yachts. But with them paying just a bit more toward the Common Good, our country will be able to reinvest in society's physical and human infrastructure, making America stronger and fairer for all.

That's why there are broad and deep public majorities — even among Republicans — supporting Biden's infrastructure plan and an increase in corporate taxes to pay for it. For more information, go to AmericansForTaxFairness.org.

To find out more about Jim Hightower and read features by other Creators Syndicate writers and cartoonists, visit the Creators webpage at www.creators.com.